India's Account Aggregator Network: A Step Towards Simplified Financial Data Sharing

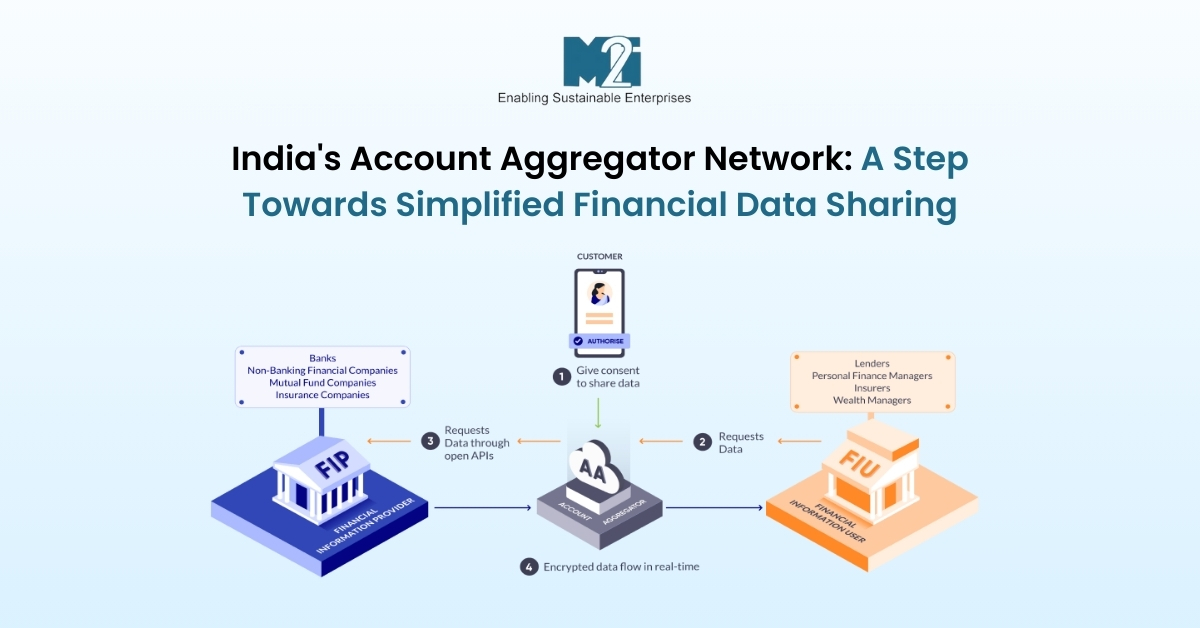

The Account Aggregator (AA) system in India represents a significant step towards enhancing financial inclusion and streamlining the process of sharing financial data among institutions with the consent of customers. Launched in 2021, the AA network allows for the secure and digital sharing of an individual's financial information across different financial institutions within the AA network. This initiative is regulated by the Reserve Bank of India (RBI) and aims to revolutionize lending, investing, and other financial services by granting consumers greater access to and control over their financial records.

Key aspects of the AA system include

-

Consent-Based Data Sharing: The AA framework operates on a consent-based model where consumers have full control over their data. They can decide what information to share, with whom, and for how long, ensuring privacy and security. This system contrasts with traditional data sharing practices, which often involve sharing broad consent at the beginning of a service without granular control over what data is shared and for what purpose.

-

Financial Inclusion: By enabling individuals to share their financial data securely, the AA network facilitates access to financial services for a wider population. This is particularly beneficial for those who may not have a substantial credit history but have sufficient digital financial transactions to demonstrate their creditworthiness. The system is designed to democratize access to credit and other financial services, leveraging digital footprints to empower consumers.

-

Interoperable Framework: The AA network supports interoperability among various financial institutions, including banks, tax authorities, insurers, and other finance firms. This interoperability allows for a more holistic view of a customer's financial health, aiding in better decision-making by financial institutions and smoother transactions for consumers.

-

Expansion and Potential: The framework's architecture is designed to be scalable and could potentially be extended beyond financial services to include healthcare, telecom data, and more. This expansion would further empower individuals by giving them control over a broader range of their personal data.

The AA system has started with major banks and is expected to grow, including more financial and non-financial institutions over time. As of recent updates, there are operational Account Aggregators with others receiving in-principle approval from the RBI. Consumers can register with any AA to access their services, with some AAs offering their services for free, charging financial institutions instead.

This innovative approach to financial data sharing is poised to make a significant impact on India's financial ecosystem, improving access to financial services, enhancing consumer control over personal data, and paving the way for a more inclusive financial landscape.