The Karnataka Case: Whose Fault Is It, and What Must MFIs Learn?

The recent Karnataka government order directing officials to restrain coercive recovery practices by MFIs has reignited memories of the Andhra Pradesh microfinance crisis of 2010. Back then, over-inde...

The Role of Microfinance in Economic Recovery in Conflict and War-Affected Areas

Conflict and war leave deep scars on societies, disrupting economies, displacing populations, and creating environments of uncertainty and instability. In such challenging contexts, microfinance can p...

A Guide to Consumer Empowerment: The Role of RBI's Charter of Customer Rights

The Reserve Bank of India (RBI) plays a pivotal role in safeguarding consumer interests in the banking and financial services sector. The RBI's Charter of Customer Rights stands as a testament to ...

RBI's Vision for Self-Regulatory Organizations in Fintech: A New Era of Governance

In a significant move, the Reserve Bank of India (RBI) released its draft norms on January 15, outlining a visionary framework for Self-Regulatory Organizations (SROs) in the rapidly evolving fintech ...

Harmonization of regulatory provisions for Housing Finance Companies and Non Banking Finance Companies

In a significant step towards regulatory harmonization, the Reserve Bank of India (RBI) announced a draft circular on January 15, aiming to align the regulations of Housing Finance Companies (HFCs) w...

Beware of Misleading Loan Waiver Campaigns: A Caution for Borrowers and Microfinance Institutions

In the ever-evolving landscape of finance, the Reserve Bank of India (RBI) has recently issued a stern warning about misleading loan waiver advertisements. https://economictimes.indiatimes.com/indust...

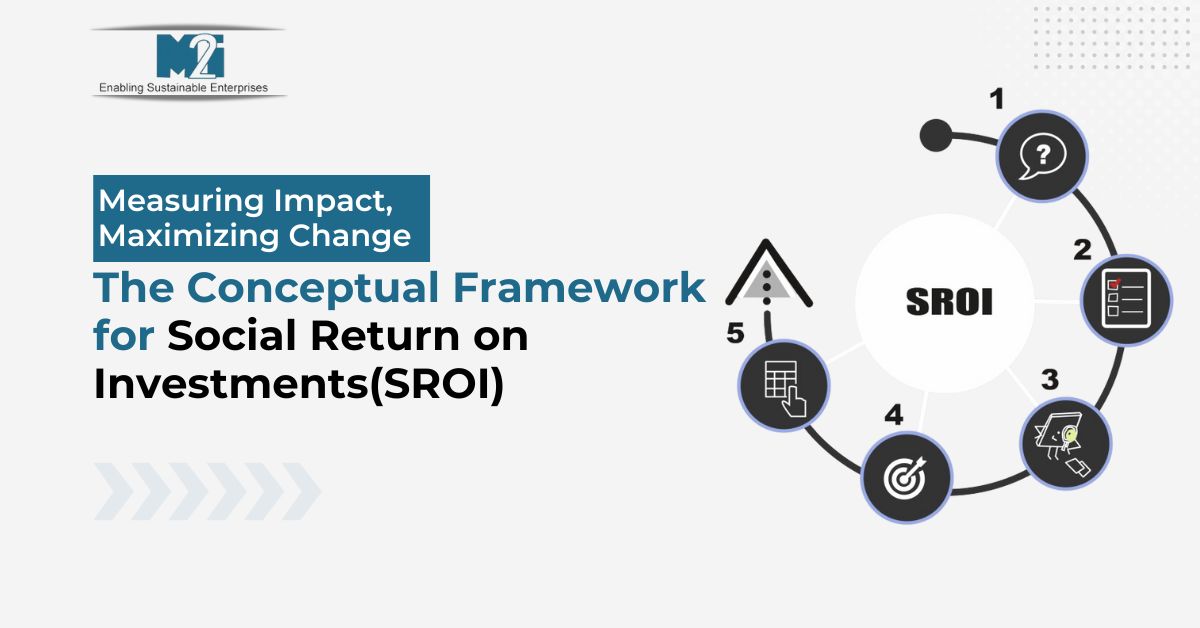

Measuring Impact, Maximizing Change: The Conceptual Framework for Social Return on Investments (SROI)

Introduction Social Return on Investment (SROI) is a framework for measuring and accounting for social and environmental values created by the organisations. SROI measures changes which are relevant t...

Scaling Up from Group Loans to Individual Loans: Institutional and Operational Imperatives

Scaling Up from Group Loans to Individual Loans: Institutional and Operational Imperatives As the demand for larger micro-enterprise loans grows, the imperative to shift from group lending to individ...

The Vital Role of Smaller and Localized Microfinance Institutions in Promoting Financial Inclusion

Microfinance Institutions (MFIs) play a pivotal role in fostering financial inclusion, and the significance of smaller, localized MFIs cannot be overstated. Unlike their larger counterparts, smaller M...

Client Protection Principles in Microfinance Institutions

Microfinance has emerged as a powerful tool for financial inclusion, providing access to financial services for millions of underserved individuals around the world. However, with its rapid growth, co...

Microfinance Client Fraud Chronicles 1

Microfinance institutions (MFIs) play a pivotal role in extending financial services to underserved populations, empowering individuals like Shardha, Pooja, Anuradha, and Mamta (assumed names) with ac...

Business Due Diligence for Investing in Microfinance Institutions: Balancing Social and Financial Returns

Due Diligence for Investing in Microfinance Institutions: Balancing Social and Financial Returns Microfinance Institutions (MFIs) have emerged as a powerful instrument for fostering financial inclusi...

E Learning Solution for the Banking and Microfinance

E Learning Solution for the Banking and Microfinance The finance industry, including banking and microfinance, is a rapidly evolving sector that demands constant learning and adaptation. With the ris...

Fraud Risk Assessment in Microfinance

Fraud Risk Assessment in Microfinance In the dynamic realm of microfinance, where institutions extend financial services to the underprivileged, the fight against fraud is an ongoing battle. As M2i C...

Time to have a relook at the IIBF certification for business correspondents

The certification program for Business Correspondents (BCs) and Business Facilitators (BFs) provided by the Indian Institute of Banking and Finance (IIBF) has become an industry standard. However, to ...

Strategies to Enhance Financial Inclusion in Geographically Remote Areas

Ensuring financial inclusion is a critical goal for economic development, and one of the significant challenges lies in reaching geographically remote areas. However, with strategic approaches and inn...

Three Ecopinion Wishes

In this Ecopinion Atul expresses three wishes Collaborative Taxation Taxation can be reimagined as a collaborative venture between citizens and the government, where taxpayers express their preferen...