Mudra Yojana and Financial Inclusion: A Quiet Revolution in Credit Access

Since its launch in 2015, the Pradhan Mantri Mudra Yojana (PMMY) has emerged as a cornerstone of India’s financial inclusion strategy. Targeted at small and micro enterprises in the non-corporate, n...

Grievance Redressal and Financial Inclusion: Two Sides of the Same Coin

Financial inclusion isn’t just about opening bank accounts or disbursing loans—it’s about creating an ecosystem where every user, especially from underserved communities, feels heard, respected,...

The Need for Cooperation Among Competitors in Microfinance: A Case for Long-Term Sustainability

In the competitive microfinance sector, where the demand for financial services far outweighs traditional access, institutions play a critical role in offering underserved populations the chance for f...

Ensuring Responsible Pricing in Microfinance: A Long-term View on Sustainability

In recent news from June 2024, the Reserve Bank of India (RBI) highlighted a critical issue in the Indian microfinance sector: instances of micro lenders and non-bank financiers charging excessively h...

The Role of Account Aggregators in India's Inclusion Journey

India's financial landscape is on the brink of a major transformation with the introduction of the Account Aggregator (AA) network, a move that could potentially bring financial services within th...

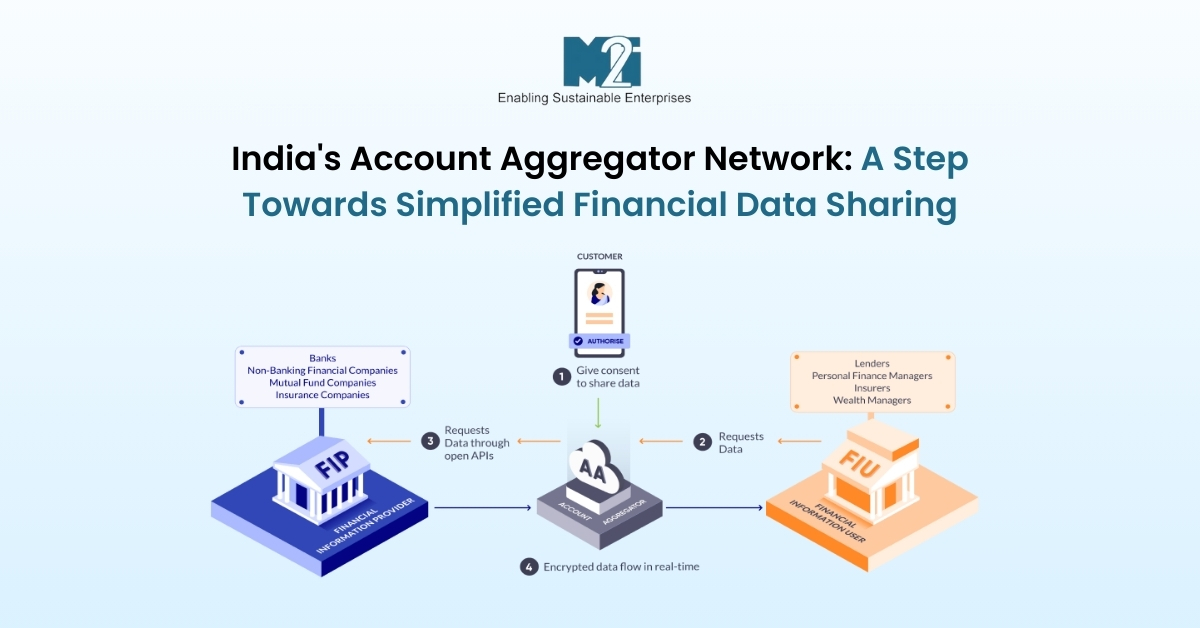

India's Account Aggregator Network: A Step Towards Simplified Financial Data Sharing

The Account Aggregator (AA) system in India represents a significant step towards enhancing financial inclusion and streamlining the process of sharing financial data among institutions with the conse...

A Guide to Consumer Empowerment: The Role of RBI's Charter of Customer Rights

The Reserve Bank of India (RBI) plays a pivotal role in safeguarding consumer interests in the banking and financial services sector. The RBI's Charter of Customer Rights stands as a testament to ...