RBI’s Firm Stance on Compliance: A Wake-Up Call for NBFCs and MFIs

The Reserve Bank of India (RBI) sent a strong message in 2024—compliance in the microfinance and NBFC sectors is non-negotiable. Recent regulatory actions, including restrictions on disbursals and o...

Best Practices for Self Regulatory Organisations in the Financial Services Industry

Self-Regulatory Organizations (SROs) in the banking and financial services industry play an important role in maintaining the integrity and stability of the sector. These entities, recognized by regul...

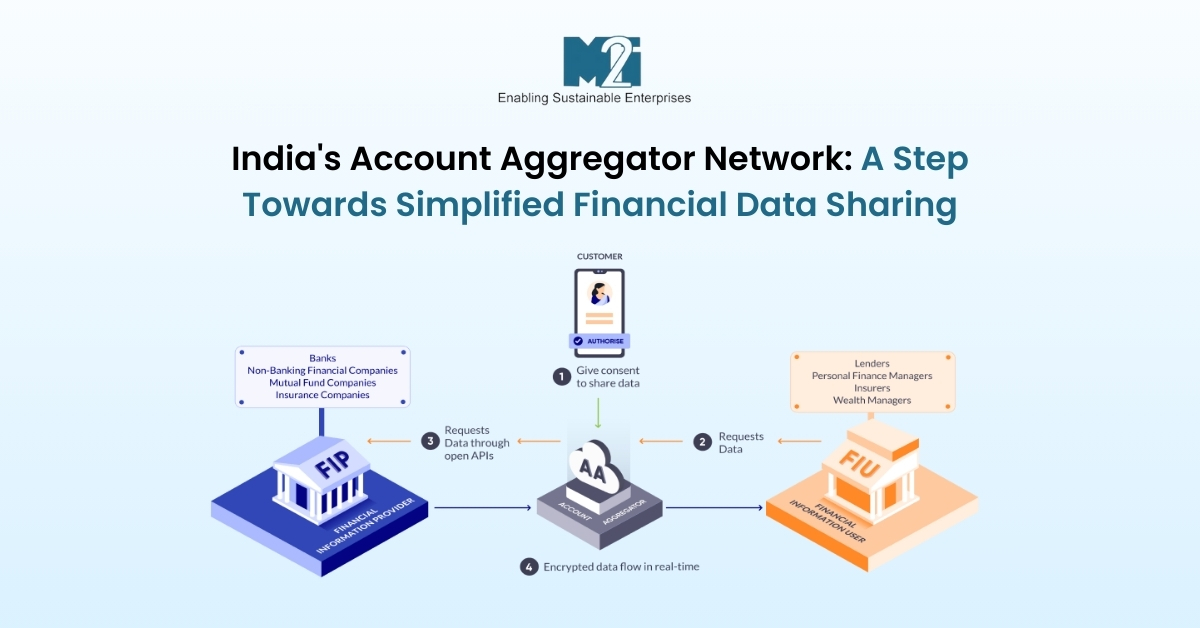

India's Account Aggregator Network: A Step Towards Simplified Financial Data Sharing

The Account Aggregator (AA) system in India represents a significant step towards enhancing financial inclusion and streamlining the process of sharing financial data among institutions with the conse...

A Guide to Consumer Empowerment: The Role of RBI's Charter of Customer Rights

The Reserve Bank of India (RBI) plays a pivotal role in safeguarding consumer interests in the banking and financial services sector. The RBI's Charter of Customer Rights stands as a testament to ...

RBI's Vision for Self-Regulatory Organizations in Fintech: A New Era of Governance

In a significant move, the Reserve Bank of India (RBI) released its draft norms on January 15, outlining a visionary framework for Self-Regulatory Organizations (SROs) in the rapidly evolving fintech ...