Grievance Redressal for Digital Financial Services: Challenges and Opportunities

As digital financial services scale rapidly across India, the need for responsive and inclusive grievance redressal systems has never been greater. Fintech platforms and digital lenders often promise ...

Financial Literacy and Inclusion: Where Does India Stand Today?

India has made major strides in expanding financial inclusion, with the RBI’s Financial Inclusion Index reaching 60.1 in 2023, up from 56.4 the year before. Jan Dhan accounts, Aadhaar, and mobile pe...

RBI’s Vision for Financial Inclusion: Balancing Growth with Stability

As the Reserve Bank of India (RBI) celebrated its 90th anniversary, Governor Sanjay Malhotra’s address reaffirmed a powerful and enduring message—the RBI remains deeply committed to financial incl...

Mudra Yojana and Financial Inclusion: A Quiet Revolution in Credit Access

Since its launch in 2015, the Pradhan Mantri Mudra Yojana (PMMY) has emerged as a cornerstone of India’s financial inclusion strategy. Targeted at small and micro enterprises in the non-corporate, n...

Grievance Redressal and Financial Inclusion: Two Sides of the Same Coin

Financial inclusion isn’t just about opening bank accounts or disbursing loans—it’s about creating an ecosystem where every user, especially from underserved communities, feels heard, respected,...

Strategies for MFIs to Mitigate the Impact of Climate Change for Their Clients and Communities

Climate change is an escalating global crisis that disproportionately affects the most vulnerable populations, particularly in developing countries. Microfinance Institutions (MFIs) have a crucial rol...

Tracking Financial Inclusion in India: The RBI FI Index

Financial inclusion is a cornerstone for economic development, and in India, significant strides have been made towards achieving this goal. The Reserve Bank of India (RBI) introduced the Financial In...

Revolutionizing E-commerce for MSMEs and the Low-Income Population: The Role of ONDC

In a rapidly evolving digital landscape, the Indian government has launched an ambitious initiative known as the Open Network for Digital Commerce (ONDC). This platform aims to transform the e-commerc...

The Crucial Role of Affordable Housing Finance in Enhancing Well-being of Low-Income Households

In the complex web of economic challenges faced by low-income households, housing affordability stands out as a critical issue with far-reaching implications for overall well-being and community stabi...

Best Practices for Self Regulatory Organisations in the Financial Services Industry

Self-Regulatory Organizations (SROs) in the banking and financial services industry play an important role in maintaining the integrity and stability of the sector. These entities, recognized by regul...

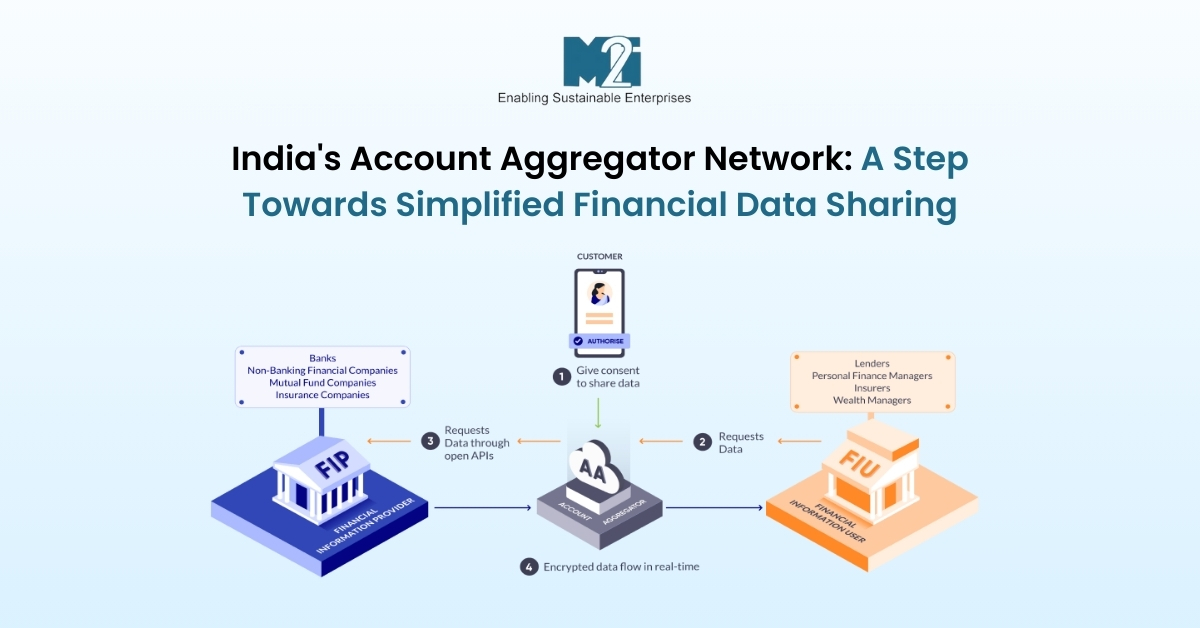

India's Account Aggregator Network: A Step Towards Simplified Financial Data Sharing

The Account Aggregator (AA) system in India represents a significant step towards enhancing financial inclusion and streamlining the process of sharing financial data among institutions with the conse...

Enhancing the Effectiveness of RBI's Customer Rights Charter

The Reserve Bank of India's (RBI) Charter of Customer Rights marks a significant step towards protecting consumers in the Indian financial sector. However, while the charter lays a solid foundatio...